Just outside of downtown Fort Worth in the James Guinn office complex is a small office suite with a staff of one doing big things for small businesses. The William Mann Community Development Corporation (WMCDC) is a Community Development Financial Institution (“CDFI”) certified by the U. S. Department of the Treasury. Their mission is to assist economic development initiatives by providing financing, in conjunction with an investor bank and/or a non-traditional lending source, for small, minority and women owned businesses, with a special emphasis on assisting businesses located in low to moderate income areas of Tarrant and Dallas County and surrounding areas.

In response to the need for non-traditional financing, the WMCDC was created in June 1994 to solve some of the financing dilemmas faced by small minority and women-owned businesses by bridging the gap between investor obtained capital and traditional bank loans and providing customized loan plans for their clients. With WMCDC financial assistance, small businesses can continue to make contributions to the economic base of the community by creating new jobs and more specifically, jobs for low-to-moderate income people.

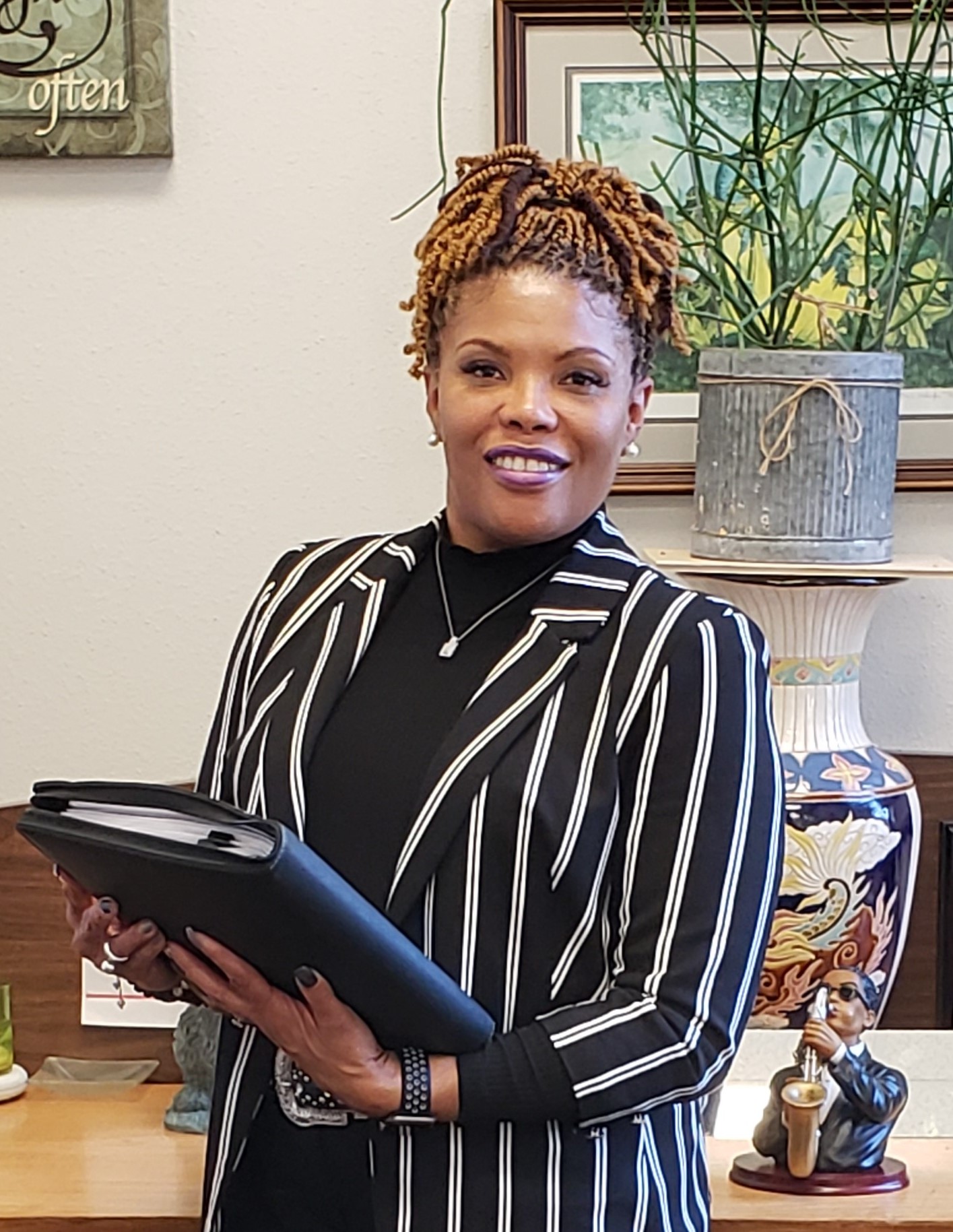

Executive Director, Kalyn Peebles has been responsible for running the organization for the last years eleven and a half years and works closely with area banks who assist in providing funding to WMCDC through their own various programs. While WMCDC is not the only entity offering this type of service, they are the only Community Development Financial Institution (CDFI) in Fort Worth and have been in business for twenty-nine (29) years.

Many small, minority and women-owned businesses face challenges, one of the main ones being access to capital. Most of these businesses are financed through the owner’s personal resources. These monies are quickly used for company operating expenses, long before money from sales begins to flow back into the business. Peebles says, “These businesses have strong potential to grow, to create jobs and to contribute to the economic base of our community if they are properly financed.” Since many of these businesses are not eligible for traditional loans, WMCDC works to educate their clients on the 5C’s of credit (character, capacity, capital, collateral, and condition) to get them the funding they need through WMCDC. “Our end goal is to assist them in becoming bankable so they can return to their financial institution in the future,” says Peebles.

To read the full story, click on the cover of the August 2023 issue of the magazine